Jumbo Loan: Open the Door to Deluxe Coping With Specialized Home Loan Options

Jumbo Loan: Open the Door to Deluxe Coping With Specialized Home Loan Options

Blog Article

The Impact of Jumbo Fundings on Your Funding Options: What You Need to Know Before Using

Jumbo lendings can play a pivotal function in shaping your financing choices, specifically when it comes to obtaining high-value buildings. Recognizing the equilibrium in between the obstacles and advantages postured by these fundings is necessary for possible consumers.

Recognizing Jumbo Fundings

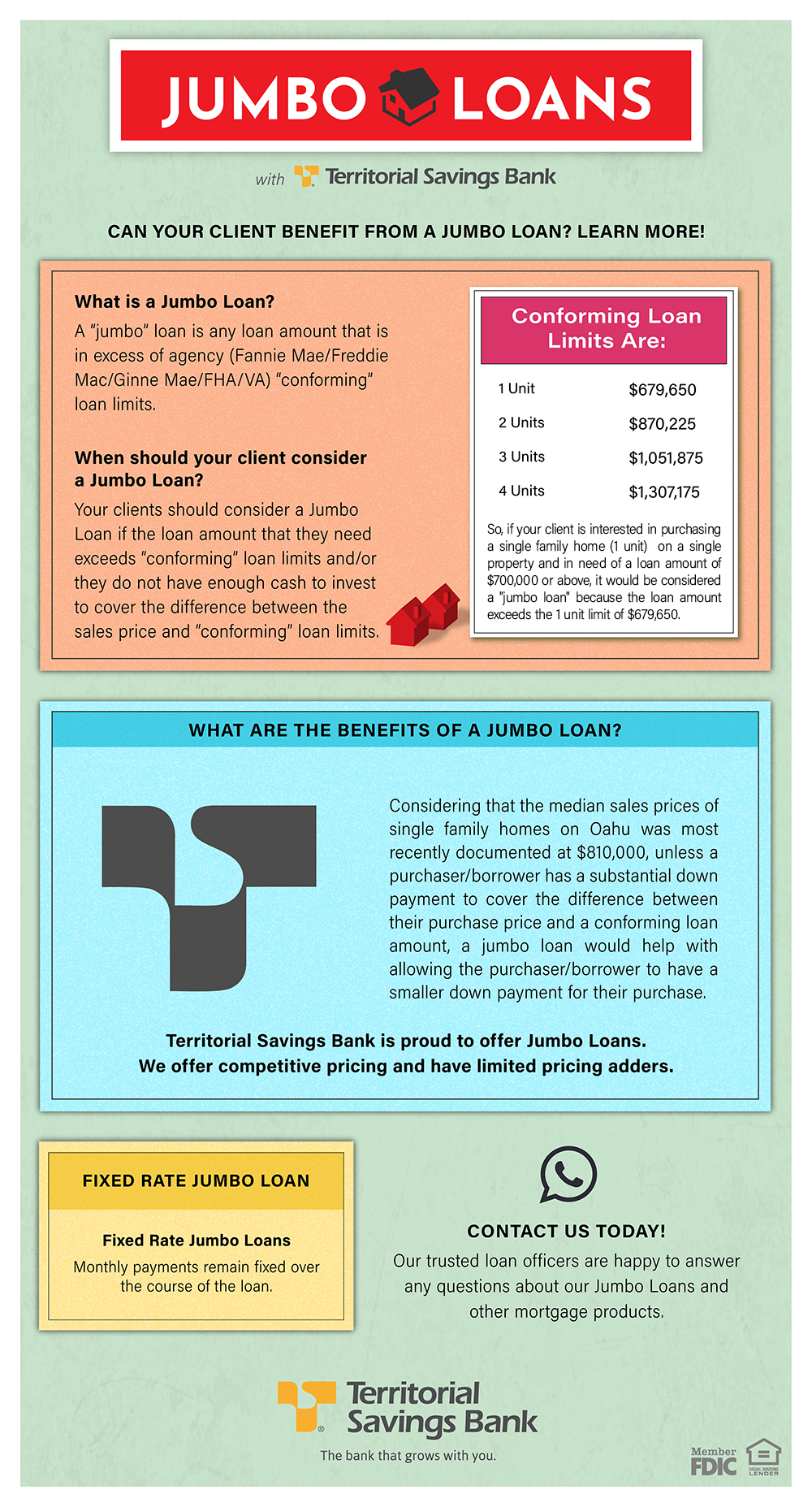

Comprehending Jumbo Loans needs a clear grasp of their unique characteristics and needs. Big fundings are a kind of home mortgage that goes beyond the adhering car loan restrictions established by the Federal Real Estate Financing Firm (FHFA) These limits vary by area however commonly cap at $647,200 in the majority of areas, making big car loans essential for financing higher-priced homes.

Among the defining functions of big car loans is that they are not qualified for acquisition by Fannie Mae or Freddie Mac, which results in more stringent underwriting guidelines. Debtors must commonly show a higher credit scores rating, typically over 700, and provide considerable documents of revenue and assets. Furthermore, lenders might require a bigger down payment-- usually 20% or more-- to minimize threat.

Rates of interest on big lendings can be somewhat greater than those for adjusting lendings because of the increased threat assumed by the lender. The lack of personal home loan insurance policy (PMI) can offset some of these expenses. Comprehending these variables is vital for possible customers, as they substantially influence the terms and feasibility of securing a jumbo finance in today's competitive genuine estate market.

Advantages of Jumbo Lendings

Jumbo financings use unique advantages for homebuyers looking for to buy high-value homes that exceed traditional lending limitations. One of the key benefits of jumbo lendings is their capacity to fund larger amounts, enabling buyers to obtain homes in costs markets without the restraints imposed by adapting financing limitations - jumbo loan. This flexibility allows homebuyers to see a wider variety of homes that may better suit their preferences and requirements

Furthermore, big finances often feature competitive rate of interest prices, specifically for customers with solid credit report profiles. This can cause substantial cost savings over the life of the funding, making homeownership more inexpensive in the lengthy run. Additionally, big finances can be customized to match individual economic scenarios, providing different terms and amortization alternatives that align with the customer's purposes.

Difficulties of Jumbo Fundings

Browsing the complexities of jumbo loans presents a number of challenges that possible borrowers ought to be conscious of before proceeding. One substantial hurdle is the rigorous loaning standards imposed by economic institutions. Unlike adapting loans, jumbo finances are not backed by government-sponsored ventures, leading loan providers to take on more strenuous criteria. This typically includes higher credit rating demands and significant documents to verify revenue and assets (jumbo loan).

In addition, big car loans commonly come with higher rate of interest contrasted to standard lendings. This raised price can considerably affect regular monthly settlements and overall affordability, making it vital for debtors to carefully evaluate their monetary circumstance. Additionally, the deposit requirements for big loans can be substantial, frequently ranging from 10% to 20% or more, which can be an obstacle for lots of possible homeowners.

One more difficulty hinges on the minimal accessibility of big funding products, as not all lending institutions provide them. This can hop over to here result in a lowered pool of choices, making it crucial for consumers to conduct detailed study and possibly seek specialized lenders. On the whole, comprehending these obstacles is crucial for any person taking into consideration a big car loan, as it makes sure educated decision-making and much better monetary preparation.

Credentials Standards

For those taking into consideration a big finance, fulfilling the certification requirements is an essential action in the application process. Unlike conventional finances, jumbo fundings are not backed by government agencies, leading to more stringent needs.

First of all, a solid credit report is crucial; most lending institutions need a minimum score of 700. A greater rating not only increases your opportunities of authorization however may additionally safeguard much better rates of interest. Furthermore, customers are usually expected to demonstrate a substantial income to guarantee they can easily handle greater month-to-month payments. A debt-to-income (DTI) ratio below 43% is normally preferred, with lower proportions being extra positive.

Deposit needs for jumbo finances are likewise considerable. Customers ought to prepare for placing down at least 20% of the home's acquisition cost, although some lenders might provide choices as reduced as 10%. Demonstrating money books is critical; lenders commonly call for proof of sufficient liquid possessions to cover a number of months' well worth of mortgage repayments.

Contrasting Funding Options

When reviewing financing choices for high-value homes, understanding the differences between different car loan kinds is vital. Jumbo fundings, which exceed adjusting loan limitations, usually featured more stringent qualifications and greater rate of interest than standard financings. These lendings are not backed by government-sponsored business, which enhances the lending institution's threat and can cause a lot more strict underwriting standards.

In contrast, conventional loans supply even more versatility and are typically simpler to obtain for borrowers with strong credit history profiles. They might include reduced rate of interest rates and find more information a larger array of alternatives, such as taken care of or variable-rate mortgages. Additionally, government-backed car loans, like FHA or VA lendings, provide possibilities for lower down payments and even more lenient credit rating needs, though they likewise enforce limitations on the funding amounts.

Conclusion

In final thought, jumbo finances existing both possibilities and obstacles for possible buyers looking for funding for high-value residential or commercial properties. While these car loans permit larger amounts without the burden of private mortgage insurance policy, they feature rigorous credentials requirements and prospective disadvantages such as greater interest rates. A thorough understanding of the challenges and benefits connected with big loans is vital for making notified choices that align with long-lasting monetary objectives and goals in the property market.

Report this page